Tax cuts for all Australian taxpayers.

From 1 July this year, the Government will:

A person on the average wage of around $73,000 will get a tax cut of $1,504.

The Government is also increasing the Medicare levy low-income thresholds for 2023-24, reducing or eliminating altogether the amount of Medicare levy paid by more than a million Australians on lower incomes.

These tax cuts will return bracket creep and lower average tax rates for all taxpayers. The plan delivers a permanent reduction in tax for all taxpayers, with an average tax cut of $1,888 in 2024–25. By 2034–35, someone earning an average income will pay $21,635 less tax than they would without these cuts. The reductions in average tax rates provide all taxpayers with greater protection against bracket creep, particularly low- to middle-income taxpayers, and support the progressivity of Australia’s tax system.

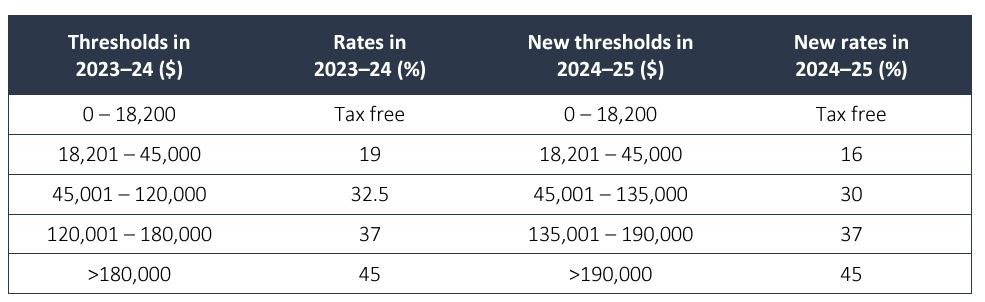

New personal tax rates and thresholds for 2024-2025

To discuss how this may affect you or your business, please give one of our accountants a call.